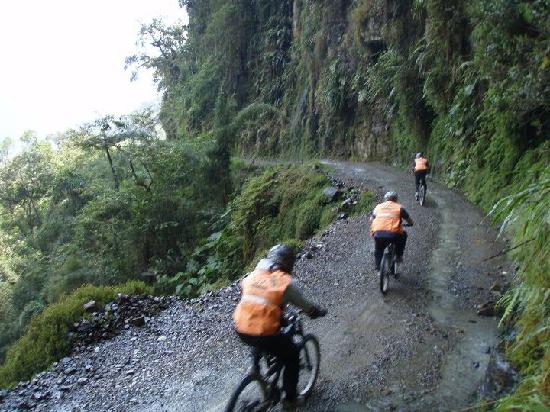

Mountain biking down the ‘Death Road’ in Bolivia and undertaking the grueling Kokoda Trek in 2008. I love travelling and I love stepping out of my comfort zone to push myself. In 2008 I undertook two amazing adventures – one was the Kokoda Track/Trail in Papua New Guinea and the other was mountain biking down the ‘Death Road’ in Bolivia (considered the world’s most dangerous road).

Kokoda Track: “more than a hike, it’s an adventure, a challenge, a rite of passage, a pilgrimage, a life changing experience”

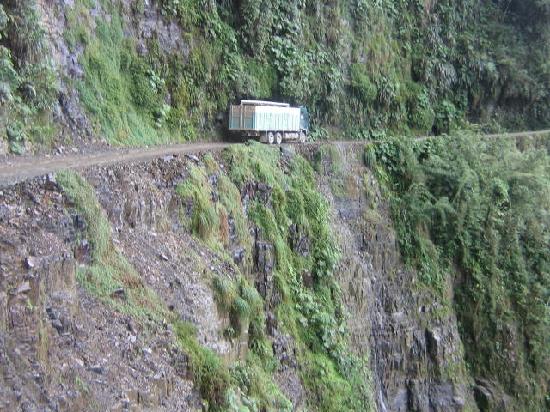

Hurtling on a bike 48km/h down a dusty truck track with an unobstructed 600m drop off a cliff

At Quantum we also have a number of clients who enjoy adventures around the world.

Paul and Margaret Kelly celebrated Paul’s retirement by undertaking part of the Camino Walk (The Way of St James) across Northern Spain

and walking across the UK and Paul is going to complete the entire Camino Walk in 2014.

In late 2013 spritely Heather and Doug Jeffery cycled around the Netherlands and they shared some shots their other adventures!

Atop Sissinghurst Castle, Kent

The ones that didn’t get away in British Columbia, Canada (coho salmon)

Tony Murphy and Karen Darby, both keen walkers and hikers recently sent in great shots of their walk through the mountains of Italy.

Karen and Tony atop the peak

Karen ascending – “The road is long, with many a winding turn”

From these wonderful adventures I share some investing lessons from hiking, climbing and trekking.

1. Importance of goals

You set your planned route and choose your gear carefully. If needed, you enlist a team of experts to guide and assist you. You know your goal is to get from A to B and you set realistic and meaningful sub-goals along the way to measure your progress. You should regularly stop and rest, re-assess your progress and adjust accordingly. Make sure you enjoy the journey as you go along.

Regardless of whether your goal is the summit of a mountain or retirement (which for some can look like an insurmountable summit sometimes!), a plan with slow and steady commitment wins the race.

2. The importance of guidance

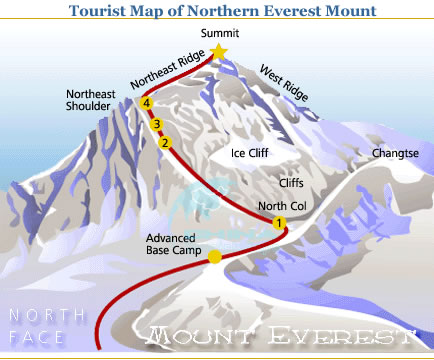

If you trek or climb yourself, clearly where possible you should follow the sign posts and stay on the established path. However, the more arduous the climb or trek (eg climbing Mount Everest!), the more important it is to hire a professional guide. When I undertook the Kokoda Track safety was paramount so I researched and then employed trusted experts to guide me. They weren’t the cheapest option but with such a significant undertaking cost is rarely the deciding factor. To my delight and reassurance, I found out a few months later that they had been featured in the press as among the best professionals in their field.

3. The right equipment

When I packed for Kokoda I balanced having enough gear for potential conditions over the journey versus not taking too much. A key lesson was to listen to the experts for what to bring and what not to bring. Over your long term investing timeframe you are going to face many varied and changing investment conditions and the approach at one time will likely not be suitable for another. The investing climate up to 2007 was clearly different to that during the GFC as it is to today. Periods of sunshine, storm and then lifting clouds all require a different approach.

4. A to B is not always a straight line

“Life’s a marathon, not a sprint. So don’t rush things. Because everything worth having, is worth waiting for” (unknown)

While my mountain bike ride down the Death Road in Bolivia was an impetuous decision (don’t ask why I did it, let’s just say it just seemed like a good idea at the time) and relatively quick, Kokoda and indeed most other treks are typically slower and well planned adventures. They criss-cross from point to point with the ultimate aim being the most efficient way of getting from A to B.

Bolivian Death road advice: “Don’t become part of the landscape”

The northern route to the top of Mount Everest

Crucially, the longer routes typically have a higher success rate. The exact same lessons apply to investing. If you seek a quick win you are gambling with your financial security. Focus on long term returns in a well devised and structured plan.

Never seek to rush or take unacceptable risks when it comes to climbing or investing. It is estimated that 200-300 travellers are killed each year on the Bolivia Death Road, and at least 18 cyclists have died since 1998. The first few hours trekking from Kokoda are referred to as the “death zone”. On Day 1 of my Kokoda trek sadly a young Australian in the group 30mins in front of us died. While he had an unknown pre-existing heart condition, he may also have been pushing himself harder than he should have in the conditions.

5. One foot in front of the other

Sometimes you can’t see your end goal. It can be obscured by clouds or around a number of bends. Even if you can’t see precisely where you are going, commit to decisive action towards a shorter term goal and have confidence that your plan will get you there. Once you commit to action it becomes habit, just like investing.

6. Uncertainty is OK, complacency is not

When you’re moving towards a life goal (whether it be investing or adventure), you have to take risks. Just accept that you will have periods of uncertainty, self-doubt and maybe even fear. I’ll admit I experienced a moment of pure fear in Bolivia. Everyone on the Kokoda trek goes through a period of doubt as they traverse the rugged Owen Stanley Range and marvel at the feats of the WWII soldiers. Markets, weather and adventure environments are unpredictable by nature. Even with doubt you should never stop and freeze, you keep moving towards your goal following the agreed plan. Sure, you should stop and reassess but never let indecision paralyse you.

__________________________

Claire Mackay LLB LLM BCom CA CFP CTA

Claire Mackay LLB LLM BCom CA CFP CTA

I am a financial planner, SMSF expert and company director. I thrive on providing independent, expert financial advice to my wonderful clients. I was recognised as Financial Planner of the Year 2015 and Investment Adviser of the Year 2014.

To contact me, speak to my team on 02 8084 0453. Please feel free to connect with me on LinkedIn or on Twitter or visit my personal website. You can also visit the Quantum Financial website.

Claire Mackay LLB LLM BCom CA CFP CTA

Claire Mackay LLB LLM BCom CA CFP CTA