Budget 2016 was the night the superannuation world shifted on its axis. Everything changed.

Front page of Australian Financial Review – ‘What the hell do we do now?’

You can also read ‘The Budget that killed SMSF growth’ and our ‘Budget 2016 Survival Guide’.

Relative political bipartisanship on superannuation ended; what was relatively simple became far more complex; and for the first time new rules were proposed that were retrospective.

In the past there really have only been two Budgets that rocked the superannuation world, and both of those made super more attractive. One was John Kerin’s 1991 Budget introducing compulsory employer super contributions (Superannuation Guarantee or SG). In reality, credit for that Budget decision should go to the then backbencher but PM in waiting, Paul Keating.

The other ground breaking superannuation Budget was Peter Costello’s in 2006 when he introduced Simpler Super including tax free pensions and the super contribution caps. In Treasurer Costello’s words at the time:

“Australia’s superannuation system is complex. The complexity associated with taxing superannuation benefits confuses retirement decisions, clouds the incentive to invest in superannuation and imposes unnecessary costs.”

Both the 1991 and 2006 Budgets established superannuation as one of the most envied self-sufficient retirement environments in the world.

Budget 2016 – We will rock you!

With that history in mind, Scott Morrison’s Budget is the very first Budget that completely rocks the superannuation world in a negative way.

Bright and early the morning after Budget 2016 we at Quantum Financial shared our thoughts with our wonderful clients in our detailed ‘Budget 2016 Survival Guide’ (available here) and called many of our clients immediately impacted. If you have a different advisor, they will have contacted you the next day too.

After releasing the report, we locked our team away in a room to brain storm the changes to devise our new strategies. From those strategy meetings we identified three new paradigms that wealthy clients must be aware of in a post Budget 2016 world.

- Paradigm 1 – Wealthy people need far more time to plan

- Paradigm 2 – The return of complexity means more need for financial advice

- Paradigm 3 – Wealthy people need asset location strategies for structuring and tax

Paradigm 1 – Wealthy people need far more time to plan

Under the pre-Budget 2016 rules, a wealthy Australian could contribute just under $2.5m over a 10 year period from age 55 to 64.

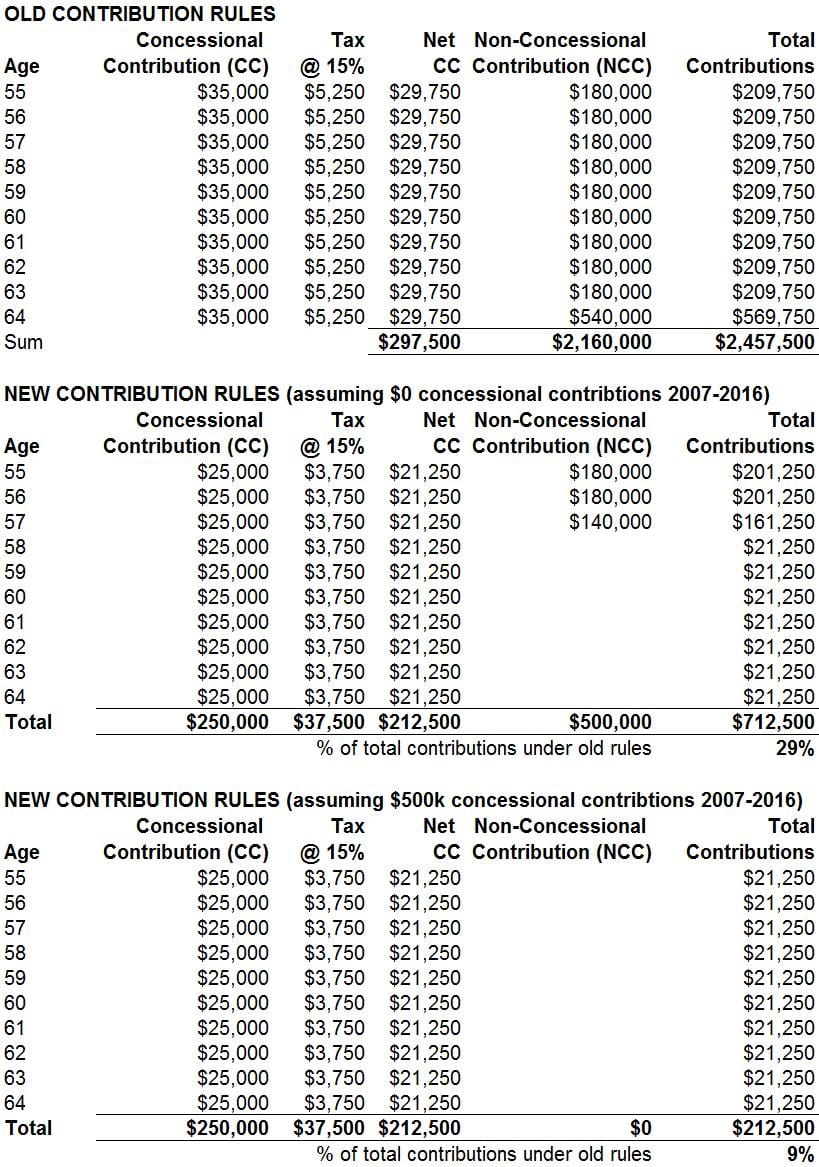

Under the new rules, the same person can only contribute 29% of that amount ($712,500) if they haven’t made any personal contributions since 2007 or as low as 9% of that amount ($212,500) if they have already hit their new lifetime $500k cap. We show our detailed analysis in Table 1 at the bottom of this article.

The result? No longer can wealthy Australians procrastinate and leave their retirement planning until the last decade of their working life. They have to start planning today.

Paradigm 2 – The return of complexity means more need for financial advice

Until Budget night, wealthy people had a fairly simple, fool proof way of investing to secure their financial future. Pay off your mortgage as soon as possible; set up a Self Managed Super Fund (SMSF), get your head around the contribution limits ($180k/$540k each year for personal contributions, $35k/$30k each year for concessional contributions); and then contribute as much as you could to your SMSF before retirement.

It was a good plan and it was one that worked well since 2007. It was fairly easy for successful people to set themselves up for their dream retirement.

On Budget night 2016 that all changed. The new rules are far more complex, there are new penalties and if you get it wrong you could be in trouble.

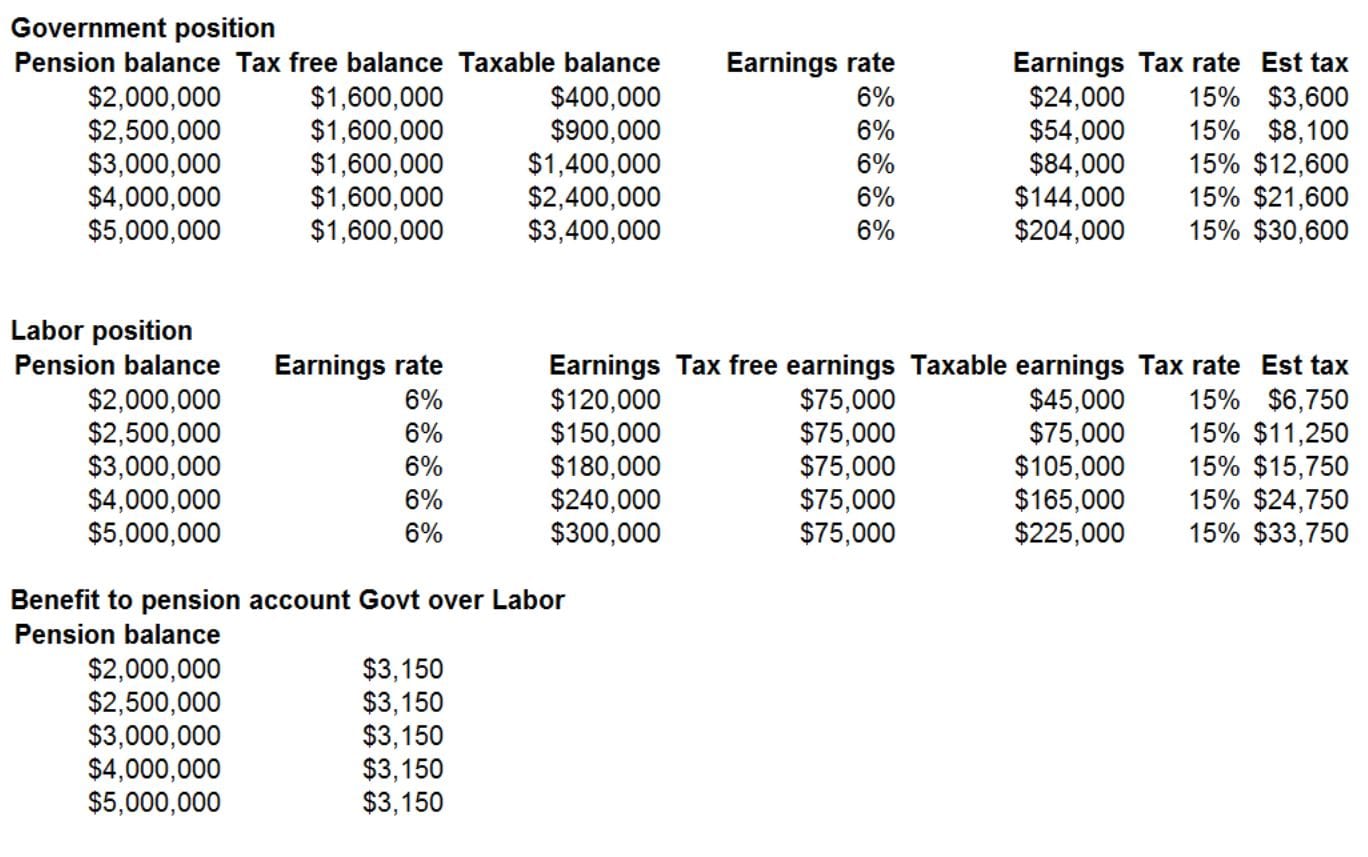

Moving forward you can only have $1.6m in a personal pension account tax free ($3.2m for a couple if you can equate balances). The rest becomes taxable even in retirement, albeit taxed concessionally at 15%.

For example, if you have $2m in a super account you could pay tax of $3,600; $3m could pay tax of $12,600; $4m could pay tax of $21,600. We show our detailed analysis in Table 2 at the bottom of this article.

Moving forward we will devise strategies for how our clients can minimise their super tax bill including the use of dividend imputation credits and asset location strategies.

Paradigm 3 – Wealthy people need asset location strategies for structuring and tax

Most investors are more than familiar with the term ‘asset allocation’. Quantum Financial clients know that asset allocation strategies lie at the very heart of how we provide our Investing Insights. Every 6 months we publish our Investing Insights report with a detailed rationale for the strategic decisions we take in client portfolios. So asset allocation is a given.

However, many investors may not have an ‘asset location’ strategy.

Again, given the structuring, legal, accounting and tax background of Quantum Financial advisors, our financial advice has long contained an asset location element at the core. We have never been and will never be tax driven but as Chartered Accountants we are always tax aware. It’s just a part of our professional make-up that we sadly can’t avoid (and which we never admit in the pub).

As discussed earlier, under the new rules the ability for investors to get money into their super is drastically reduced. Your ability to transition to retirement tax effectively is gone. How much you can hold tax free in your pension account is also significantly reduced.

Combined, these changes mean you need alternative tax effective ways to invest your wealth. You don’t want to be leaving a tip for the tax man by paying too much tax – he just doesn’t deserve it. Those alternatives are your ‘asset location’ strategy.

This may include a company structure (with a lower tax rate of 27.5% for small companies from the 2016 Budget); trust/s or individual/joint holdings of your investments. Every client’s situation will be different and needs tailored independent advice.

Moving forward, wealthy clients approaching retirement will have a fundamental need for independent financial advice that incorporates structuring, tax, accounting, superannuation, SMSF and estate planning advice.

We at Quantum Financial are incredibly lucky that we are positioned exactly where our clients need us post Budget 2016. Not only are we qualified Certified Financial Planners and SMSF Advisors, we are Chartered Accountants and lawyers with investment banking and legal experience in structuring and estate planning.

We have perfectly positioned our family office based service on providing our successful, yet incredibly time poor, clients with trusted independent advice on tax effective Self Managed Super Funds, companies, trusts, investment management and estate planning.

Investors need to quickly adapt to the 3 paradigms of the new superannuation world that we have highlighted. They need to take action as soon as possible to secure the dream retirement that they and their family deserve.

Appendix

Table 1: Ker-ching! Amount of tax to be paid by retirees with more than $1.6m in super

Table 2: How much wealthy people can get into super over 10 years under new and old super rules